19 November 2021

Canada’s export supply chains are in a world of hurt.

What happens when an already fragile supply-chain that has had code-red warnings issued by local and national associations gets hit with unprecedented weather events that create further major disruption. We are going to find out in Canada.

Credit to Globe and Mail

Last night we got emails from multiple suppliers and hopped on the phone to get a more personal perspective. Of course, every commodity is different. However, let's just focus in on lentils for a bit. Canada is really a competitor to Australia in this category, so what happens to them impacts our own pricing as growers adjust to a changed market situation.

Here are a few select quotes:

Prior to this week, shipping through Vancouver was already basically impossible as no vessels were arriving to take cargo, so all cargo was being diverted to Canada's other major port, Montreal

Vancouver has been in the news, and we ourselves have experienced four-to-eight-week delays between booked date for shipment and what we are eventually getting. So far, our planning had been that this is a worst case.

Now, all major Transloaders in Montreal are refusing all inland deliveries effective immediately, both rail and truck, due to a backlog and lack of space at facilities.

Ray Mont facilities in Montreal

In discussion we have likened this to a flood of water, where it is running up against a barrier in one area, it is washing back and finding a new area to flood. Somehow, it needs to stop raining for at least a month to allow the flood waters to recede – but that is just not happening.

With no containers at ports, no empties are being repositioned inland to production facilities which means that container availability has become a major problem.

Viterra Vessel at Port Lincoln

For Australia, this is our primary problem as well. For certain commodities it is alleviated by our biggest exporters leasing bulk vessels for high volume broad acre commodities – but it significantly disadvantages any smaller exporters and lower value/volume agricultural commodities we are trying to export.

A record setting storm that hit the west coast this past week has destroyed multiple sections of rail line and the highways that were a secondary route to port. So, for at least 2 – 4 weeks, there is no way to get cargo to port.

It isn't like climate scientists haven't been warning us that extremes in the cycle of wet and dry weather won't get worse. These effects of this storm can't be blamed on overbuilding on flood plains or damning rivers, it is just simply the volume of water dumped at a particular time of year is unprecedented in modern history.

As of yesterday, Canada has been cut off from global containerized markets. We believe it will be 3-6 months from now (with no idea of eventual costs) before any new business written will be able to be shipped.

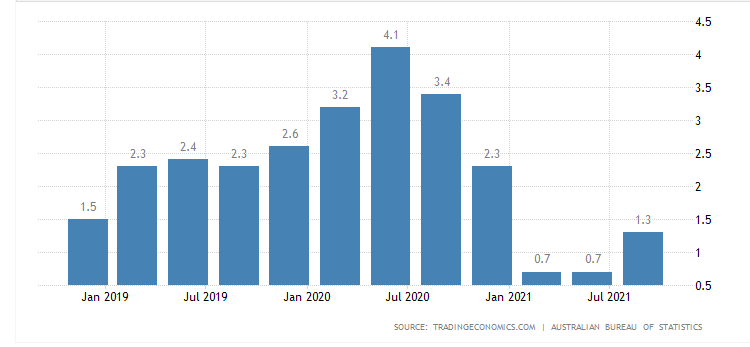

Quarterly Australian Food Inflation (ABS)

For Australia this will be a threat and opportunity. We would expect to see further pressure on food inflation (already on the way up), but opportunities for Australian exporters who have access to export capacity – either containers or via bulk terminals.

Trying to use US ports with transload is difficult for anyone trying to switch as the US has in effect made decisions to priorities US company exports (already constrained by backlog) and so Canada has nowhere else to turn.

The impact will be beyond Canada. Many United States companies were diverting freight to Canada (which is no longer an option and caused many of Vancouver's problem in the first place). Given this is not an option for the near future, we are likely to see further increased export delayed from the United States. We are also seeing further evidence of the United States preferencing their own companies over Mexico and Canada when it comes to export. This may have further ramifications over time on relations.