30 March 2021

Should food ingredients be financial instruments?

Before actually working full-time in the industry I would have said yes. Financial markets help marry supply and demand, they create price transparency.

Now, the answer is more nuanced, the answer has a direct bearing on my company and the question of how global societies deal both with food security and food diversity.

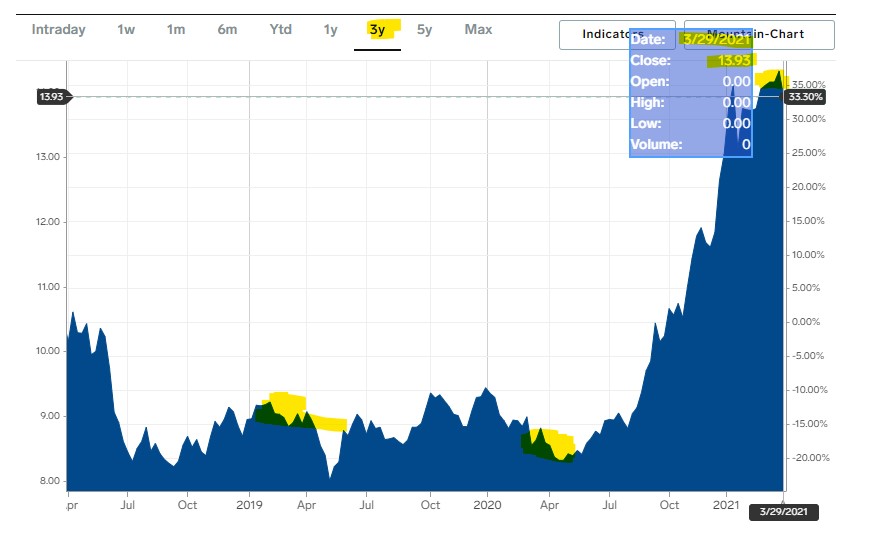

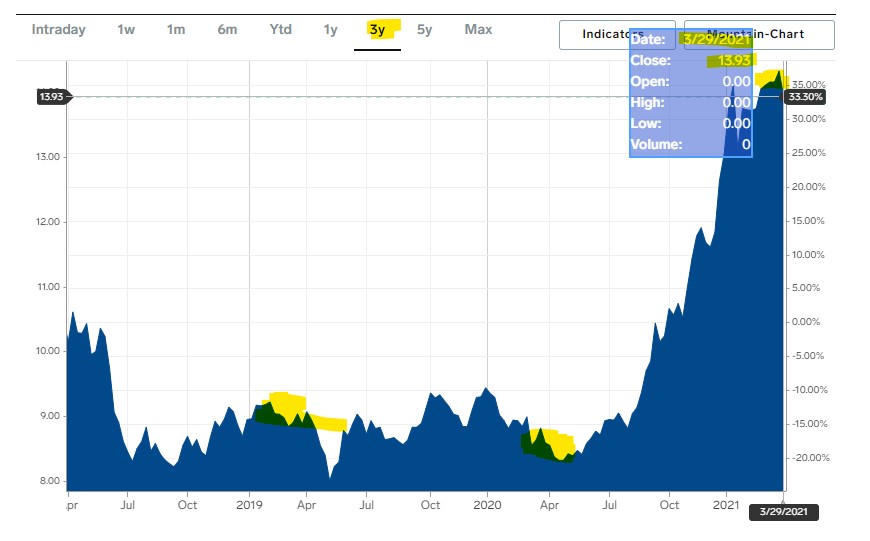

I received a stark warning from one of my Canadian suppliers last night. They will not be able to contract their total required 2021 crop acreage and will need to give a haircut to custom allocations for 2022. The reason: not floods, not droughts, not crop disease or an infestation of mice. No the problem is that publicly traded soy beans and corn are crowding out all other crops as farmers chase returns. The issue can be highlighted by the following three year graph of soy beans.

3 year prices for Soy beans

The run up in prices since May 2020 has been so fast that traditional non-tradeable commodities have been unable to compete. Now normally you would just say this is the market being efficient.

The problem is that we don't know what component of that price run-up is genuine demand and what is a monetary system awash with stimulus cash globally chasing returns in commodities – no different from bitcoin and shares as returns in holding cash have continued to drop.

The issue is that the impacts of these flows of capital are real. They impact the long term viability of diverse range of food crops that people buy (further driving monoculture) and take a long time to course correct. I think like other public tradeable markets, questions need to be asked about whether they are resulting in efficient financial allocation of investment dollars or are encouraging speculation and bubbles that result in wastage and real damage to underlying markets.

I can't help but feel this is a similar impact to the dramatic consolidation of financial investment in Australia into the residential and commercial property. It too has resulted in increased cost of living, a less diverse economic base (as investment dollars elsewhere dry up) and a focus on financial speculation rather than how to efficiently deploy capital to improve the lives of as many people as possible.

Whilst lots of people have written about the danger of Australia's housing market, my favourite wrap-up by Craig Tindale and Matt Barrie (old but relevant), there are far future people writing independent on he issues with capital investment flows in food crops. There are individual blogs who are anti-soy or anti-corn, but so far I haven't found a good wrap-up beyond environmental or individual country-specific concerns.